KARACHI:

With Pakistan’s mortgage-to-GDP ratio abysmally low — below 1% — owing to the absence of a proper mortgage system, the federal government intends to launch a new subsidised housing finance scheme in the upcoming fiscal year. The initiative aims to spur demand in the real estate and construction sectors while making homeownership more accessible to middle- and lower-income groups. However, the scheme, loosely modelled after the earlier Mera Pakistan Mera Ghar programme, may face significant challenges, including a lack of clarity on eligibility and structure, persistently high land and construction costs, and limited affordability among target beneficiaries.

Despite a Rs5 billion subsidy proposed in the 2025-26 federal budget, concerns remain over banks’ willingness to lend aggressively, given Pakistan’s mortgage-to-GDP ratio is still languishing below 1%. Experts caution that unless the scheme is backed by strong institutional coordination, tax reforms, and public awareness, it may fall short of its objectives — much like the previous attempt, where only Rs235 billion was approved out of Rs514 billion in financing requests.

The State Bank of Pakistan (SBP) will oversee the rollout of the new scheme. While the proposed housing finance will subsidise a portion of the markup rate to make it affordable for beneficiaries, the eligibility criteria, categories, name, and structure may differ from the previous initiative.

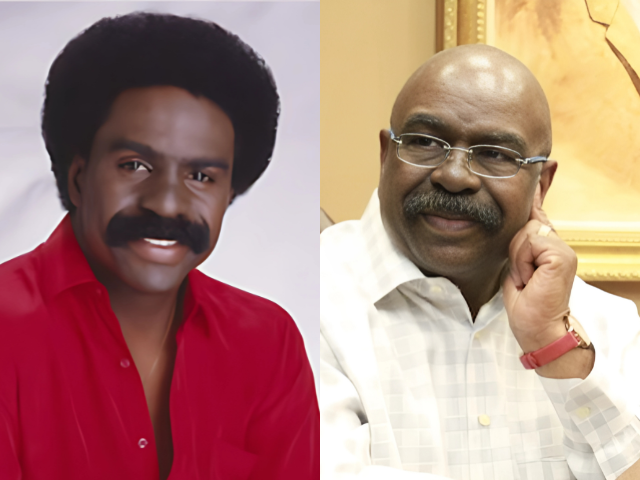

Ibrahim Amin, a real estate valuation and engineering expert, noted that the government is considering the launch of the housing finance scheme due to favourable conditions following a gradual reduction in the policy rate, which may decline further in the coming months if macroeconomic indicators improve.

“The housing finance scheme will help revitalise economic activities in real estate, construction, and allied sectors, attracting local and foreign investments from residents and overseas Pakistanis while generating jobs across the entire ecosystem,” said Amin, who is also the CEO of TriStar International, a real estate valuation company.

He added that the scheme could improve sales of hundreds of unsold or undersold housing units in private residential societies across major cities, which have struggled due to rising inflation and declining purchasing power among target buyers.

The government has also announced tax relief on property transactions, which may further stimulate the market in the coming months, Amin noted.

The previous subsidised housing finance scheme, introduced in 2019 by the central bank, was discontinued by mid-2022 due to high interest rates. Despite overwhelming public responsewith participating banks receiving financing requests worth Rs514 billiononly Rs235 billion was approved across thousands of applications.

“The banking regulator, alongside commercial banks, played a crucial role in facilitating the public through awareness campaigns, dedicated facilitation desks, and revised scheme conditions,” Amin said. “The initiative also boosted economic activity in real estate and construction while providing long-term consumer financing opportunities for banks.”

He emphasised that Pakistan’s banking system now has a well-tested and researched framework for housing finance, with stakeholders fully prepared to execute their roles. “It is high time for the government to announce the policy to benefit the masses,” he remarked.

Pakistan currently faces an estimated shortage of 1.2 million housing units relative to its population, while its mortgage-to-GDP ratio remains below 1%the lowest in the region.

“Reviving affordable housing finance could play a crucial role in addressing both housing needs and broader economic recovery,” said Karachi-based realtor Maaz Liaquat.

He pointed out that high land and construction costs have dampened bookings for small and mid-sized apartments in major cities in recent years. The new subsidised financing scheme could support builders and developers of ready and under-construction vertical housing projects, attracting overseas Pakistanis and middle-income buyers.

Liaquat suggested that the government collaborate with district authorities to streamline real estate regulations while reducing the tax burden on scheme beneficiaries to make homeownership more affordable for first-time buyers.